Taxes for Thee, But Not for Me: The Brotopian Dream

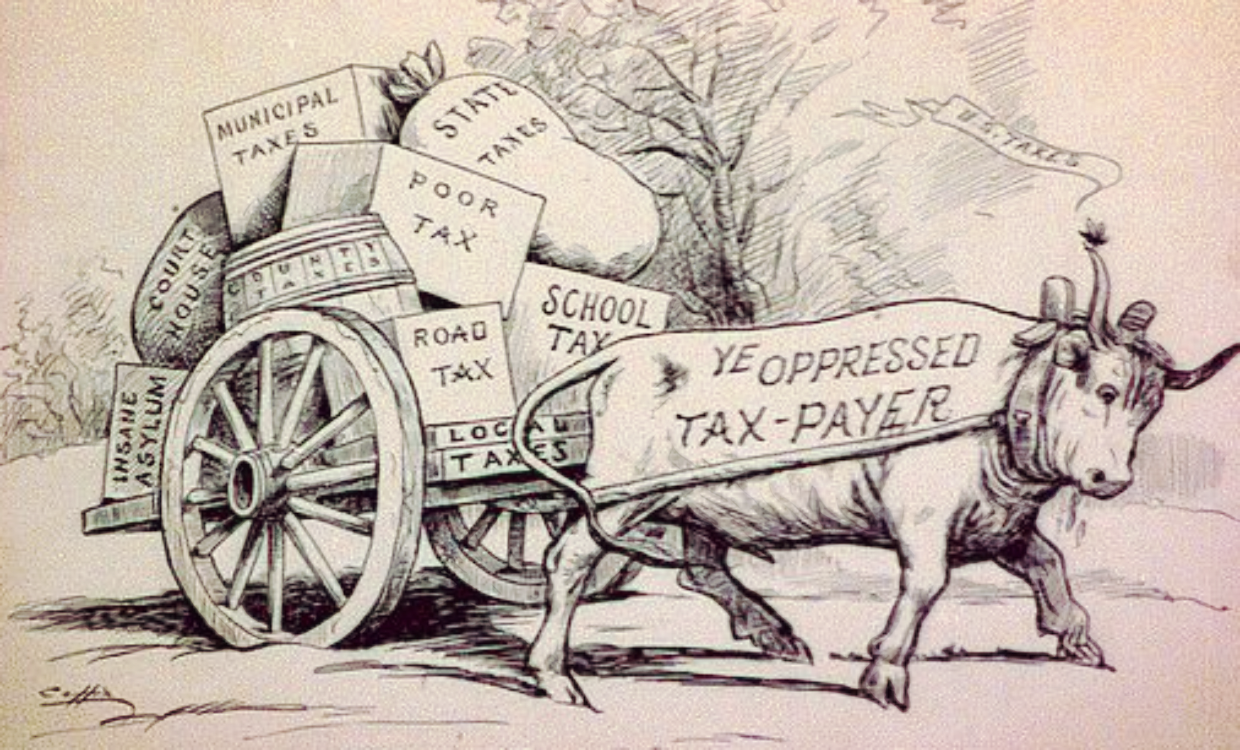

The guys I call the brotopians – the tech billionaires funding charter cities, network states, and various other grandiose and extremely stupid schemes to “exit democracy” – tend to be a very particular brand of libertarian. That is, the kind who thinks that taxation is theft when it’s applied to them, but a civic duty for everyone else. Because who else is going to pay for the tens of billions of dollars in government contracts going to their companies?

Take Peter Thiel. (Please!) Thiel, a major backer of the charter city investment vehicle Pronomos Capital, just donated $3 million to fight California's proposed five percent wealth tax on billionaires, a one-time levy that could be spread across five years. That's one percent a year, for five years, and that's it. He's furious about this terrible imposition.

Yet his company Palantir has received billions in taxpayer-funded government contracts, including a $10 billion Army software deal and nearly $800 million from the Pentagon since Trump took office in 2025.

Then there's Sam Altman, whose OpenAI recently landed more than $200 million in Pentagon contracts after quietly removing the clause in their terms of service that prohibited military use of their technology. Altman is a major investor in Praxis, the "network state" scheme to build a libertarian city in Greenland – or California, or the Mediterranean, or wherever will have them.

Meanwhile, Palmer Luckey's Anduril Industries, backed by Thiel and Marc Andreessen, has swallowed up over $1 billion in defense contracts, including a $642 million Navy deal. Andreessen himself bankrolls Praxis and Pronomos Capital.

I think you may have noticed a trend here.

Adding the proverbial insult to the proverbial injury, these guys actually pay almost nothing in taxes, compared to the rest of us.

Please forgive a little more wonkishness here because I looked all these details up and this shit is genuinely maddening. If you aren't a lefty already this might make you one.

So here we go: ProPublica crunched the numbers and found that the 25 wealthiest Americans saw their wealth grow by $401 billion between 2014 and 2018 … while paying just $13.6 billion in federal income taxes, a "true tax rate" for the mega-billionaires of 3.4%. (Many famous names pay far less, sometimes nothing at all. Click that link above for all the horrifying details.) Compare this to the middle-class family paying around 26% when you include all the various taxes they pay.

How do these guys with so much manage to pay so little? Because the system taxes wealth far less than work. Most people, you see, make money through wages (or sometimes donations hint hint), taxed at rates up to 37%, plus payroll taxes. The top billionaires make their money through investments – stocks, real estate, businesses – taxed as "capital gains" at a maximum rate of 20%, with no payroll tax at all.

Even better, or worse for our purposes here, those gains aren't taxed until you sell. So billionaires just … don’t sell. They borrow against their assets, live off the loans (which aren't taxed), and watch their wealth grow tax-free. When they die, their heirs get a "step-up in basis" that erases all those untaxed gains forever. It's called "Buy, Borrow, Die," and it's how you turn your family into a dynasty while contributing almost nothing to the society that enabled you to get so fucking rich.

Of course, many of these dudes are also into dubious and untested “life-extension” technologies and hope to never actually die. But that’s a topic for another post, or ten.

Despite their personal allergies to taxes, these guys don’t want to live in some sort of postapocalyptic Mad Max world without effective taxation of any kind. No, they’d rather live in our more comfortable world where tax money flows into their pockets – through those oh-so-lucrative government contracts m – but where they’re largely immune from having to pay into the system that rewards them so generously.

Still, like the dog Jennie in Maurice Sendak’s Higglety Pigglety Pop, but without her charm or talent, they can’t help but think that “there must be more to life than having everything!” Enter charter cities and network states, which offer largely tax-free zones in a world where everyone else pays taxes. That’s the dream, anyway; these guys have trouble actually getting the things up and running in the real world.

And the gap between the dream and the reality is where this newsletter or blog or whatever it is will live.